forex rsi indicator

Ready to start trading forex. The oscillator works on the following theory.

How To Trade With Rsi In The Fx Market

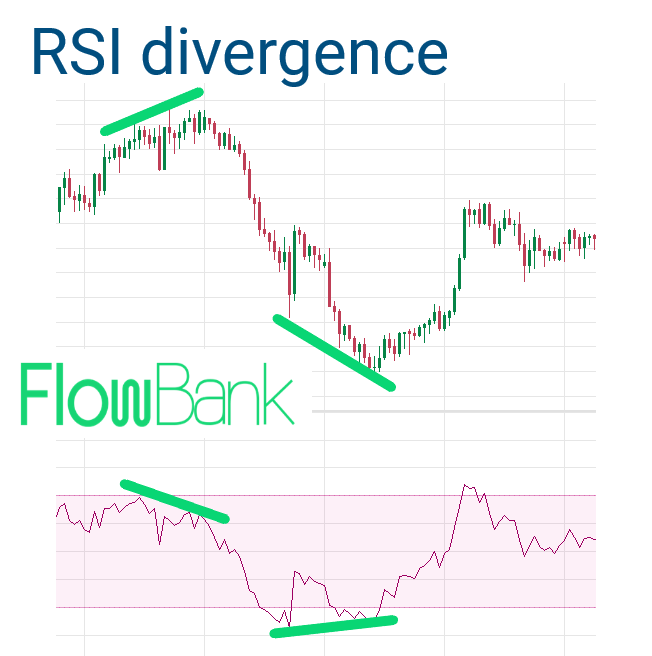

The relative strength index RSI is a momentum indicator developed by noted technical analyst Welles Wilder that compares the magnitude of recent gains and losses.

. There is no such thing as the best technical indicator in Forex. The technical indicator attempts to find a medium-to-long-term trend followed by a target entry point. If you would like to pay through Crypto Currencies follow click the button below.

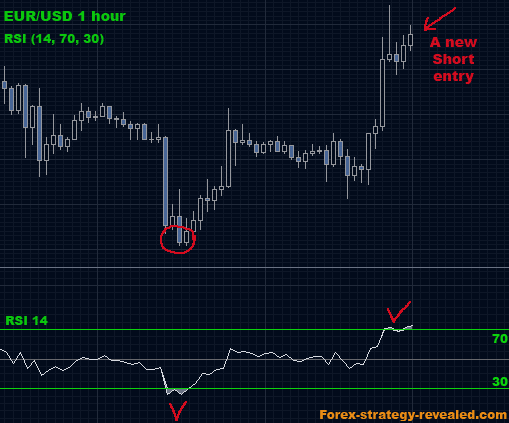

Conversely an RSI that dips below the horizontal 70 reference level is viewed as a bearish indicator. Since some assets are more volatile and move quicker than others the values of 80 and 20 are. If you would like to pay through Perfect Money log in or create a Perfect Money account and send 37 to U14173568 with message For Forex C 15 Trader Strategy and you will receive indicator download information within 24 hours.

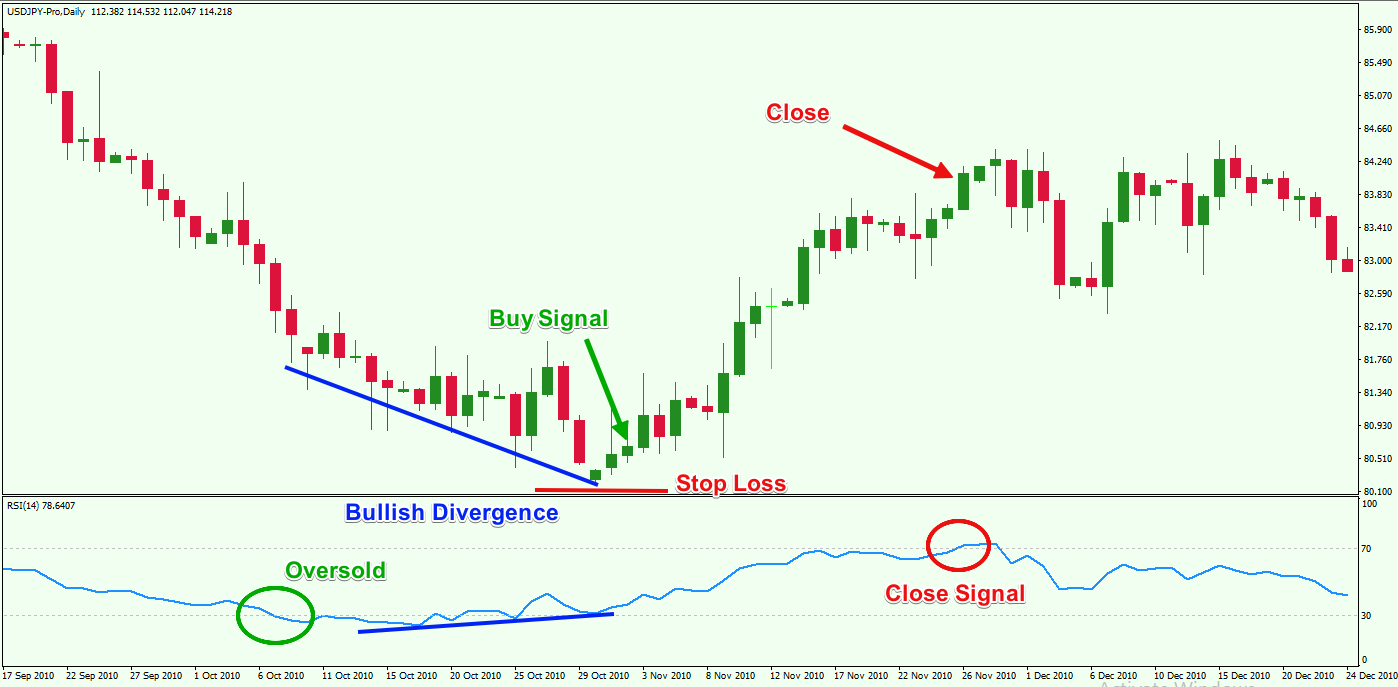

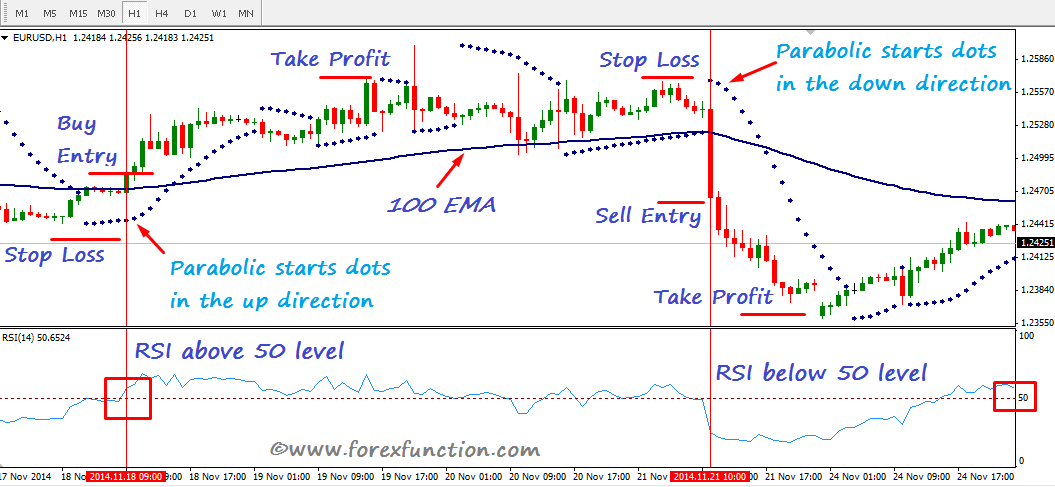

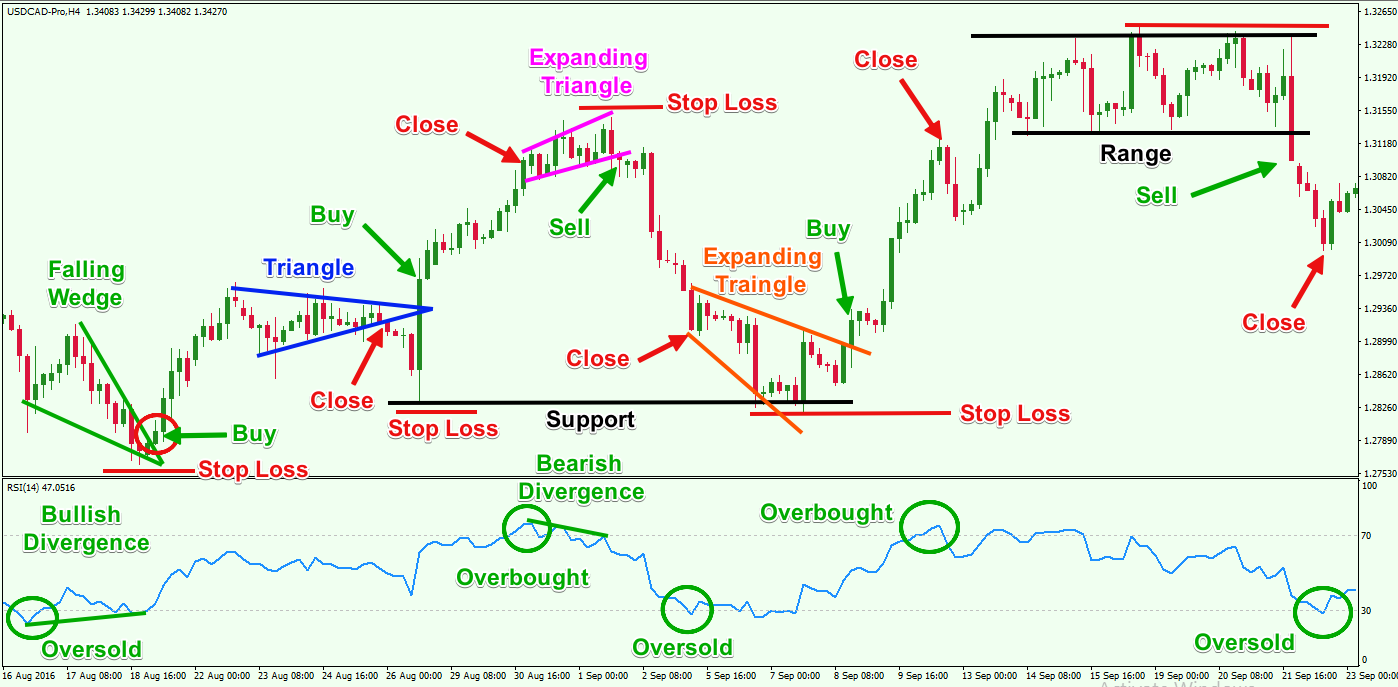

Moving average convergence divergence MACD is a trend-following momentum indicator that shows the relationship between two moving averages of prices. Fibonacci retracement levels are also important in the forex signals space. How to Trade Using RSI.

During a downtrend prices will likely remain equal to or below the previous closing price. It is so easy to jump and start using the Forex RSI indicator for day trading that novice traders often begin without testing different parameters or educating themselves on the proper interpretation of an indicator because of the desire to grab money quickly. The Stochastic oscillator is another technical indicator that helps traders determine where a trend might be ending.

At the end of the day it all comes down to your particular. The RSI indicator is designed to measure the momentum while a moving average is designed to smooth out the trend. This simple momentum oscillator was created by George.

Our guide explores the best forex indicators for a simple strategy including Moving Average MACD Stochastic and RSI. Relative Strength Index - RSI. Our forex trend indicator will enable you to tell whether prices are likely to increase or decrease.

As a result the RSI has become one of the most widely misused MT4 indicators. More specially it looks to enter the trend when the. Moving Average Convergence Divergence - MACD.

This indicates the market trend is weakening in strength and is seen as a bearish signal until the RSI approaches the 30 line. A falling centerline crossover occurs when the RSI value crosses BELOW the 50 line on the scale moving towards the 30 line. During an uptrend prices will remain equal to or above the previous closing price.

RSI can be used just like the Stochastic indicator. GBP is heavily overbought on the RSI.

Double Stochastic Rsi Indicator 4xone

Forex Trading Strategies With Rsi Indicator

Rsi Forex Trading Strategy How To Trade The Relative Strength Indicator Rsi

Rsi Indicator Secrets Powerful Trading Strategies To Profit In Bull Bear Markets Youtube

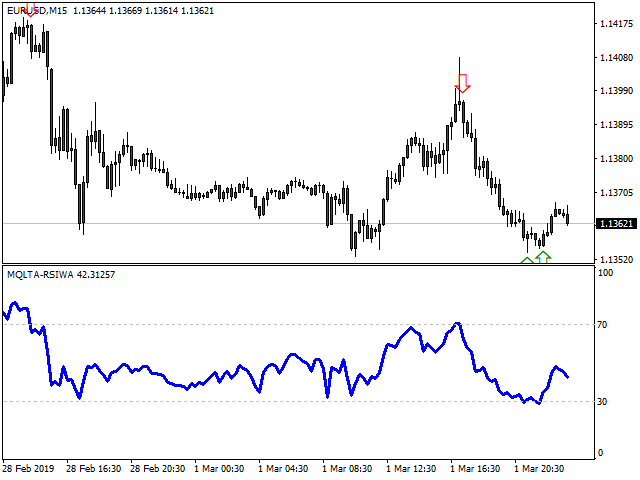

Rsi With Alert For Mt4 And Mt5

How To Use Relative Strength Index Rsi In Forex Trading Forex Training Group

How To Use Rsi Relative Strength Index In Forex Babypips Com

Tipu Rsi Indicator Review Forex Academy

A Trader S Guide To The Relative Strength Index Rsi Indicator Ig Us

Forex Trading Strategy With Ema Parabolic Sar And Rsi

Rsi Indicator Fully Explained Learn Forex Forextraders

20 Sma With Rsi Forex Trading Strategy

Rsi Indicators For Mt4 Page 34

Relative Strength Index Top 5 Important Roles Of Rsi

Rsi Trading Strategy Best Rsi Setting For Day Trading

Forex Trading Strategy 4 Rsi High Low Forex Strategies Systems Revealed

Easy Forex Trading Strategies Buying And Selling Using Rsi

How To Use Relative Strength Index Rsi In Forex Trading Forex Training Group